Overview

The Housing and Advancement Board (HDB) is Singapore's community housing authority, responsible for offering reasonably priced housing selections to its citizens. Just one popular way of proudly owning an HDB flat is in the usage of an alternative to acquire (OTP). An OTP can be a authorized document that grants the customer the special ideal to acquire a certain HDB flat in a specified period.

Purpose of the OTP

An OTP serves various needs in the entire process of buying an HDB flat:

Exclusive Right: By getting an OTP, the client ensures that no other individual should buy the particular HDB flat throughout the validity interval said in the option.

Time for Conclusion-Building: The validity time period allows enough time for consumers To judge their fiscal scenario, evaluate eligibility and suitability, and find guidance right before committing to get.

Flexibility: The buyer has adaptability through the validity interval as they could decide whether to exercise their selection according to transforming situations for instance mortgage acceptance or preferential place tender benefits.

Steps Associated with Getting an OTP

To acquire an OTP for acquiring an HDB flat, various steps must be adopted:

Choose a Flat: Decide on the desired spot, style, dimension, and price tag number of your favored HDB flat.

Check out Eligibility: Make sure you meet all eligibility criteria set by HDB with regards to citizenship standing, spouse and children nucleus composition, age specifications, revenue ceiling boundaries, and many others.

Submit an application for Loan Approval In Principle (AIP): It is essential to apply for AIP from banking institutions or economic institutions ahead of applying for an OTP as this assists decide your highest bank loan volume determined by your money ability.

Submit Application for Oct & Watch for Outcomes: Right after receiving AIP approval from banking companies/economical establishments; submit on-line application as a result of e-Company portal termed "Profits Launch".

Receive Offering Letter: In the event your software is productive, you will get an giving letter from HDB with Directions on how to e book an appointment and commence to obtain the OTP.

Book Appointment & Finish Reserving of Flat: Book an appointment in a specified HDB Hub branch to accomplish the required paperwork, make payments, and gather the OTP doc.

Crucial Terms and Conditions within an OTP

When obtaining an OTP for paying for an HDB flat, there are plenty of essential terms and conditions outlined from the document:

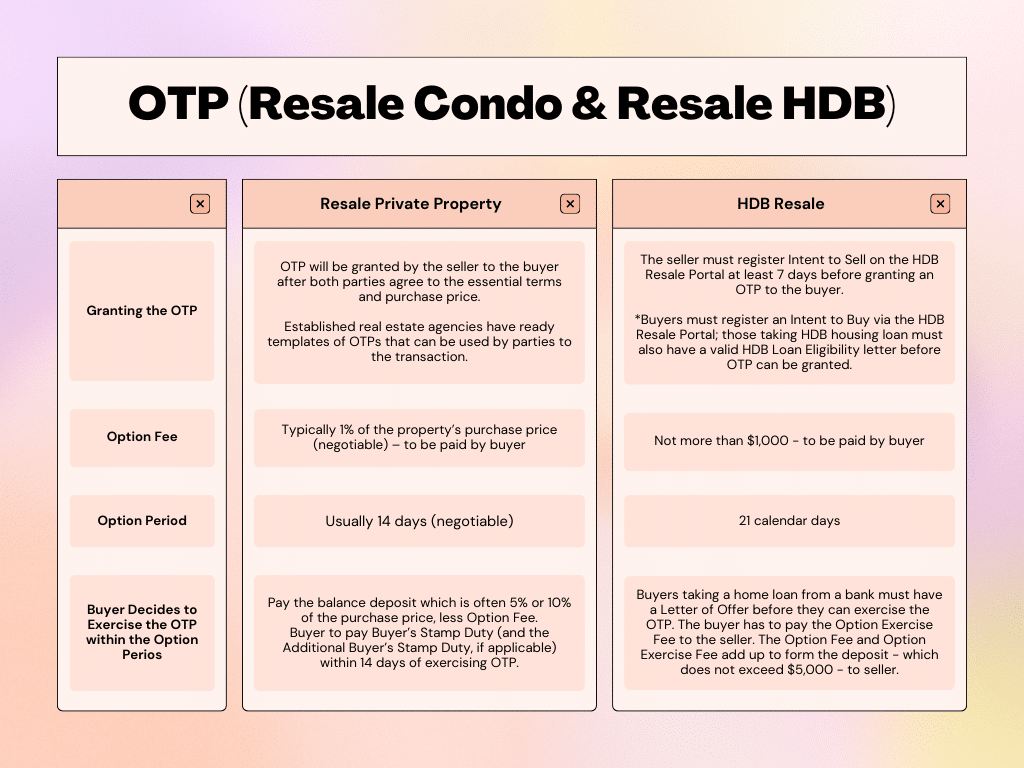

Validity Interval: The time period in just which the client can decide whether to physical exercise their possibility and proceed with the purchase.

Purchase get more info Price tag: The agreed-on value concerning the client and vendor for the HDB flat.

Selection Fee: A partial payment created by the customer as consideration for acquiring special rights underneath the choice.

Workout Cost: An additional price payable by the customer when working out their selection to invest in within the validity period of time.

Training or Letting Go of a choice

In the validity period of time mentioned within the OTP, customers have two solutions:

Performing exercises Option:

Having to pay any harmony downpayment expected (ordinarily 20% of buy value).

Confirming funding preparations that has a lender or economical institution.

Collecting keys to new flat upon completion of all legal processes.

Continuing Based on HDB's suggestions for resale flats or Construct-to-Buy (BTO) flats.

Allowing Go of Selection:

Forfeiting any expenses paid out through reserving: solution cost, work out cost, and many others.

Allowing for Many others serious about paying for that individual HDB flat all through remaining profits start/application periods.

It is important for probable customers to bear in mind that failing to physical exercise their choice by not finishing requisite steps inside of its validity period may perhaps bring about them to get rid of the option service fees forfeit in its entirety.

Summary

The Option to invest in (OTP) is an important document in the whole process of obtaining an HDB flat. It provides buyers with exceptional rights, time for decision-building, and suppleness before confirming their invest in. Comprehension the actions associated, crucial terms and conditions, and doable outcomes when performing exercises or letting go of a possibility is vital for people taking into consideration HDB possession.

Comments on “Options To invest in”